Web designer insurance is an essential safeguard for professionals in the ever-evolving digital industry. As a web designer, your role is critical in creating visually stunning and functional websites, but what happens if a client disputes your work, a cybersecurity breach compromises sensitive data, or an accidental error leads to costly downtime? Without the right insurance, these scenarios could put your business and financial future at serious risk.

In today’s fast-paced online world, clients expect web designers to deliver not just creativity but also reliability and security. This makes protecting your business with comprehensive web designer insurance a smart and necessary decision. Whether you’re a freelancer, part of a small team, or running a full-scale web design agency, having the right coverage ensures you’re prepared for unexpected challenges.

In this guide, we’ll explore the importance of web designer insurance, the types of coverage you should consider, and how to choose a policy tailored to your unique needs. From professional liability insurance to cyber risk protection, we’ll show you why having the right insurance isn’t just about peace of mind—it’s about positioning yourself as a professional, trustworthy designer in the eyes of your clients.

What Is Web Designer Insurance and Why Do You Need It?

Web designer insurance is a tailored form of business insurance designed to protect professionals in the web design industry from financial and legal risks. Whether you’re a freelance web designer or running a full-scale agency, this insurance helps safeguard your business from challenges like client disputes, data breaches, or accidental errors in your work. According to Hiscox, professional liability insurance is essential for freelancers to protect against claims of negligence or unmet expectations.

Understanding Web Designer Insurance

Web designers face specific risks that can impact their reputation and finances. A small mistake, like an overlooked coding issue or a missed deadline, can lead to significant problems. Having the right insurance ensures that these risks don’t derail your career or business growth. For example, as highlighted by Next Insurance, professional liability insurance covers errors, omissions, or project delays that could result in client losses.

Types of Web Designer Insurance

- Professional Liability Insurance (Errors and Omissions)

This insurance protects you if a client sues for perceived mistakes or a failure to deliver services as promised. For instance, if a website you designed causes operational issues for a client, this coverage can handle legal fees and settlements. Learn more about its importance from Awifu Labs. - General Liability Insurance

General liability insurance is crucial for covering accidents like property damage or injuries. If you work from a home office and a delivery person slips and falls on your property, this insurance will help cover their medical expenses. Companies like Hiscox offer customizable plans for small businesses and freelancers. - Cyber Liability Insurance

In today’s digital landscape, cyber threats are a growing concern for web designers. If a hacker breaches your systems and accesses client data, cyber liability insurance can cover recovery costs and damages. According to Next Insurance, this type of policy is increasingly essential for freelancers handling sensitive client information. - Business Owner’s Policy (BOP)

A BOP combines general liability insurance with property coverage to protect your office equipment, such as computers and servers. If your equipment is stolen or damaged, this policy helps you replace it without significant financial strain.

Why Do You Need Web Designer Insurance?

Web designer insurance isn’t just about protecting your finances—it’s about ensuring the longevity and professionalism of your business.

- Protection Against Client Lawsuits

A dissatisfied client could claim your work caused financial losses. For instance, a missed project deadline might lead to the client losing potential revenue, prompting them to take legal action. As Next Insurance explains, having coverage means you won’t have to shoulder the cost of defending yourself. - Boosts Credibility

Clients trust businesses that are prepared for unforeseen circumstances. Having insurance demonstrates your professionalism and readiness to handle challenges. - Compliance with Contract Requirements

Many large clients and agencies require proof of insurance before working with web designers. Meeting this requirement makes you a more attractive partner, as detailed on Hiscox.

The Risks Web Designers Face Without Insurance

As a web designer, your expertise lies in creating visually stunning and functional websites, but operating without insurance exposes you to various risks that could jeopardize your career and financial stability. Here are some of the major challenges web designers face when they lack adequate insurance:

1. Client Disputes and Legal Claims

Web designers often deal with high-stakes projects involving strict deadlines and client expectations. If a client believes your work caused them financial harm—such as a website malfunction or missed deadline—they may file a lawsuit. Without insurance, you could be responsible for legal fees, settlements, or court judgments, which can amount to thousands of dollars.

For instance, a client might claim that a design flaw on their e-commerce site caused them to lose sales. In such cases, Next Insurance explains that professional liability insurance can cover legal costs and damages, but without it, these expenses come directly out of your pocket.

2. Cybersecurity Breaches

Web designers often handle sensitive client data, such as login credentials, payment integrations, and proprietary information. If your systems are compromised by a cyberattack or data breach, you could face liability for the damages caused to your client.

According to Hiscox, cyber liability insurance is crucial for mitigating risks like data breaches and ransomware attacks. Without it, the costs of recovery, fines, and client compensation can be overwhelming.

3. Financial Losses from Errors or Omissions

Even the most experienced web designers are not immune to mistakes. A simple error in coding or forgetting to include a critical feature in a project can lead to client dissatisfaction and financial losses. Clients may demand compensation or refuse to pay for your work, putting your business’s cash flow at risk.

Professional liability insurance, as highlighted by Awifu Labs, ensures that such errors are covered, allowing you to maintain your reputation and financial stability.

4. Damage to Equipment or Property

Your tools, such as computers and software, are essential for your work. If they’re damaged by fire, theft, or other unforeseen circumstances, replacing them can be costly. Without a business owner’s policy (BOP), you’re left to shoulder these expenses alone.

A BOP, which combines general liability and property insurance, can help cover the costs of repairing or replacing your equipment, as explained by Next Insurance.

5. Loss of Credibility with Clients

Operating without insurance can make your business appear less professional to potential clients. Many clients, especially larger organizations, require proof of insurance before signing a contract. Without it, you may miss out on lucrative opportunities and struggle to establish trust in competitive markets.

According to Hiscox, being insured signals to clients that you take your responsibilities seriously and are prepared for any eventuality.

How to Choose the Right Insurance Policy for Your Web Design Business

Selecting the right insurance policy for your web design business can feel overwhelming, especially with so many options available. However, taking the time to assess your needs and understand your risks will help you find the best coverage to protect your business. Here’s a step-by-step guide to help you choose the right insurance policy:

1. Assess Your Business Needs

Start by evaluating the specific risks associated with your work as a web designer. Consider:

- The size of your business (freelancer, small team, or agency).

- The type of clients you work with (individuals, startups, or large companies).

- The services you provide (web design, hosting, SEO, etc.).

- Your reliance on technology and sensitive client data.

For example, if you handle client data or offer e-commerce solutions, you may need cyber liability insurance. Learn more about protecting your business from cyber risks on Hiscox.

2. Understand the Types of Insurance Available

Familiarize yourself with the most relevant types of insurance for web designers:

- Professional Liability Insurance (Errors and Omissions): Protects you if a client claims your work caused financial harm due to errors or missed deadlines.

- General Liability Insurance: Covers accidents like property damage or injuries that occur during business activities.

- Cyber Liability Insurance: Protects against data breaches and cyberattacks.

- Business Owner’s Policy (BOP): Combines general liability and property insurance to cover equipment damage or theft.

Explore detailed explanations of these policies at Next Insurance.

3. Compare Coverage Options

Not all policies are created equal. Look for policies that offer:

- Comprehensive coverage tailored to web design.

- Flexible limits and deductibles that fit your budget.

- Coverage for remote work and client locations, if applicable.

Many providers, like Awifu Labs, offer tailored solutions for creative professionals to ensure your coverage aligns with your specific needs.

4. Check Provider Reputation

Choose an insurer with a solid track record of working with small businesses and freelancers. Research:

- Customer reviews and ratings.

- Claims process and response time.

- Experience in offering insurance for web designers or tech-related businesses.

Sites like Hiscox and Next Insurance are known for their focus on freelancers and small business owners.

5. Balance Cost and Coverage

While affordability is important, avoid sacrificing essential coverage for a lower premium. Consider:

- The total cost of premiums vs. potential risks.

- Discounts for bundling policies (e.g., a BOP).

- The policy’s exclusions and limitations.

For instance, if you work on high-value contracts, ensure your professional liability insurance covers the potential financial impact of errors or delays.

6. Consult an Expert

If you’re unsure about your coverage needs, consult an insurance broker or advisor who specializes in small businesses. They can help you identify the best policies for your business and ensure you’re not over- or under-insured.

7. Regularly Review Your Policy

As your business grows, your insurance needs may change. Review your policy annually to ensure it still meets your requirements. For example, if you expand your services to include hosting or SEO, you may need additional coverage.

Top Insurance Providers for Web Designers in the United States

Finding the right insurance provider is crucial for protecting your web design business from financial and legal risks. In the United States, several insurance companies specialize in offering tailored coverage for freelancers and small business owners, including web designers. Below is a list of the top providers:

1. Hiscox

Hiscox is a well-known provider that offers customized insurance policies for small businesses, including web designers.

- Key Features:

- Professional liability insurance (errors and omissions) tailored to web designers.

- General liability insurance to cover property damage and injuries.

- Cyber liability insurance for data breaches and cyberattacks.

- Why Choose Hiscox:

- Flexible policies with monthly payment options.

- Coverage for freelancers and small agencies.

- Easy online quote process.

- Learn More

2. Next Insurance

Next Insurance specializes in providing affordable and straightforward insurance solutions for freelancers and small businesses.

- Key Features:

- Comprehensive professional liability and general liability coverage.

- Cyber insurance to protect against data breaches.

- Policies designed specifically for creative professionals.

- Why Choose Next Insurance:

- Competitive rates starting as low as $25/month.

- Fully digital platform for managing policies and claims.

- Instant coverage certificates.

- Learn More

3. The Hartford

The Hartford is a trusted insurance provider with a wide range of policies designed for small businesses, including web designers.

- Key Features:

- Business owner’s policy (BOP) combining general liability and property coverage.

- Professional liability insurance to cover errors and omissions.

- Workers’ compensation insurance if you employ staff.

- Why Choose The Hartford:

- Strong reputation and excellent customer service.

- Tailored coverage for various industries, including tech professionals.

- Access to risk management resources.

- Learn More

4. Chubb

Chubb offers high-quality insurance products, focusing on businesses that require comprehensive and reliable coverage.

- Key Features:

- Professional liability insurance for claims related to negligence or missed deadlines.

- Cyber liability insurance for advanced digital protection.

- Property insurance for expensive equipment like laptops and servers.

- Why Choose Chubb:

- Global presence, ideal for web designers with international clients.

- High limits and customizable policies.

- Excellent claims handling process.

- Learn More

5. CoverWallet

CoverWallet is an online insurance platform that simplifies the process of finding and managing business insurance.

- Key Features:

- Access to quotes from multiple insurance providers.

- Professional liability, general liability, and cyber insurance options.

- Business owner’s policies for bundled coverage.

- Why Choose CoverWallet:

- Quick and easy comparison of policies.

- Affordable options for freelancers and small teams.

- Dedicated customer support to guide you.

- Learn More

6. Progressive Commercial

Progressive Commercial is a popular choice for small business insurance, offering a variety of coverage options.

- Key Features:

- General liability and professional liability coverage.

- Workers’ compensation insurance for businesses with employees.

- Business owner’s policy for bundled savings.

- Why Choose Progressive Commercial:

- Competitive pricing and discounts for bundling policies.

- A+ rating from the Better Business Bureau.

- Trusted provider with extensive experience.

- Learn More

7. Thimble

Thimble provides on-demand insurance for freelancers and small business owners, making it a great choice for web designers who need flexibility.

- Key Features:

- Pay-as-you-go coverage for one-off projects or ongoing needs.

- Professional liability and general liability insurance.

- Instant policy setup and certificates of insurance.

- Why Choose Thimble:

- Ideal for project-based work.

- Affordable and flexible plans.

- No long-term contracts.

- Learn More

8. Liberty Mutual

Liberty Mutual offers a wide range of small business insurance policies, with tailored options for web designers.

- Key Features:

- Professional liability and general liability insurance.

- Cyber liability insurance for data protection.

- Property insurance for office equipment.

- Why Choose Liberty Mutual:

- Trusted provider with nationwide coverage.

- Customized policies for specific industries.

- Online tools for managing policies and claims.

- Learn More

How Much Does Web Designer Insurance Cost?

The cost of web designer insurance depends on various factors, such as the size of your business, the type of coverage you need, and your risk profile. On average, freelance web designers can expect to pay anywhere from $25 to $50 per month for basic coverage, while agencies may pay higher premiums based on their team size and revenue.

Factors That Influence the Cost of Web Designer Insurance

- Type of Coverage

- Professional Liability Insurance: Typically costs $20 to $50 per month for freelancers and $50 to $100 for small agencies.

Example: This covers claims related to errors, omissions, or missed deadlines. - General Liability Insurance: Costs $30 to $60 per month, depending on the level of risk.

Example: This protects against property damage or third-party injuries. - Cyber Liability Insurance: Costs $50 to $150 per month for basic data breach protection.

Example: This is essential for web designers handling sensitive client data.

- Professional Liability Insurance: Typically costs $20 to $50 per month for freelancers and $50 to $100 for small agencies.

- Business Size and Revenue

- Larger agencies or designers handling high-value contracts typically pay more due to the increased risk.

- Claims History

- A clean claims history often results in lower premiums, while a history of claims may increase costs.

- Coverage Limits and Deductibles

- Higher coverage limits and lower deductibles result in higher premiums but offer more protection.

- Industry and Clientele

- Designers working with high-risk clients (e.g., financial institutions) may pay more due to the potential for significant losses.

Average Costs for Web Designer Insurance

| Type of Insurance | Average Monthly Cost | Average Annual Cost |

| Professional Liability Insurance | $20–$50 | $240–$600 |

| General Liability Insurance | $30–$60 | $360–$720 |

| Cyber Liability Insurance | $50–$150 | $600–$1,800 |

| Business Owner’s Policy (BOP) | $50–$100 | $600–$1,200 |

Ways to Save on Web Designer Insurance

Bundle Policies

Many providers, such as Next Insurance, offer discounts when you bundle multiple policies, like professional liability and general liability.

Increase Your Deductible

Opting for a higher deductible can lower your monthly premiums, though you’ll pay more out-of-pocket in case of a claim.

Pay Annually

Paying for your policy annually instead of monthly can save you 10–15% on total costs.

Shop Around

Compare quotes from different providers to find the most affordable option for your needs. Platforms like Hiscox and Thimble allow you to get quick quotes online.

Maintain a Clean Record

Avoid claims by following best practices, such as using contracts, securing client data, and maintaining clear communication.

Steps to Get Web Designer Insurance

Securing web designer insurance is a straightforward process when you follow the right steps. Whether you’re a freelancer or running a small agency, having the right coverage ensures your business is protected from unexpected risks. Here’s a step-by-step guide to help you get the insurance you need:

1. Evaluate Your Risks and Needs

Start by assessing the potential risks your business faces. Consider:

- The type of services you offer (e.g., web design, hosting, SEO).

- The size of your business (freelancer, small team, or agency).

- The type of clients you work with (startups, corporations, or individuals).

- Specific risks, such as client disputes, cyberattacks, or equipment damage.

For example, if you handle sensitive client data, cyber liability insurance is essential. Learn more about evaluating risks on Hiscox.

2. Research the Types of Insurance You Need

Familiarize yourself with the coverage options available for web designers:

- Professional Liability Insurance: Covers claims of negligence, missed deadlines, or errors in your work.

- General Liability Insurance: Protects against property damage or third-party injuries.

- Cyber Liability Insurance: Protects against data breaches or cyberattacks.

- Business Owner’s Policy (BOP): Combines general liability and property insurance.

For a detailed explanation of each type, visit Next Insurance.

3. Compare Insurance Providers

Research insurance providers that specialize in small businesses and freelancers. Look for:

- Competitive pricing and flexible plans.

- Good customer reviews and fast claims processing.

- Experience with creative professionals and tech-related businesses.

Providers like Hiscox, Next Insurance, and Thimble are popular choices for web designers.

4. Request Quotes

Get quotes from multiple providers to compare costs and coverage options. Most companies, like Awifu Labs, offer online tools to provide instant estimates. When requesting a quote:

- Provide accurate details about your business size, revenue, and services.

- Specify the coverage limits and deductibles you prefer.

5. Review Policy Details

Before purchasing a policy, carefully review the terms and conditions. Pay attention to:

- Coverage Limits: Ensure the policy covers potential claim amounts.

- Exclusions: Check what is not covered (e.g., intentional acts or pre-existing issues).

- Premiums and Deductibles: Confirm monthly or annual costs and the amount you’ll pay out-of-pocket for claims.

6. Purchase Your Policy

Once you’ve chosen the best policy for your needs, complete the purchase process. Most providers allow you to buy insurance online for added convenience.

- Ensure you receive a certificate of insurance as proof of coverage. This document may be required by clients before starting a project.

7. Regularly Update Your Coverage

As your business grows or changes, update your insurance policy to match your evolving needs. For instance:

- Expanding your services (e.g., adding hosting or SEO) may require additional coverage.

- Hiring employees may require workers’ compensation insurance.

8. Implement Risk Management Practices

While insurance protects you, reducing risks can help prevent claims and lower your premiums. Best practices include:

- Using clear contracts for every project.

- Securing client data with robust cybersecurity measures.

- Maintaining regular backups of all project files.

Benefits of Having Insurance as a Web Designer

Insurance isn’t just an added expense; it’s an essential investment in the long-term stability and success of your web design business. Here’s why having insurance is crucial for web designers:

1. Financial Protection Against Lawsuits

Web design projects often come with high expectations, tight deadlines, and complex deliverables. If a client claims that your work caused financial harm—whether due to a missed deadline, coding error, or website downtime—they may file a lawsuit. Without insurance, you could face significant legal fees, settlements, and other costs.

- Example: A client sues you for not delivering a website on time, claiming lost revenue. Professional liability insurance (errors and omissions) can cover your legal defense and any damages awarded.

- Why It Matters: Even a single lawsuit can cost tens of thousands of dollars, but insurance ensures your business survives such challenges. Learn more about protecting your business on Hiscox.

2. Credibility and Professionalism for Clients

In competitive industries like web design, clients look for professionals they can trust. Having insurance demonstrates that you take your responsibilities seriously and are prepared for unexpected challenges.

- Client Confidence: Many clients, especially larger organizations, require proof of insurance before signing contracts.

- Reputation Boost: Insurance positions you as a professional who prioritizes risk management, making you a more attractive choice compared to uninsured competitors.

3. Peace of Mind in Your Business

Running a web design business can be stressful, especially when dealing with high-stakes projects. Knowing that you’re protected from legal and financial risks allows you to focus on what you do best—creating stunning websites.

- Stress Reduction: You can take on projects with confidence, knowing you have a safety net in case something goes wrong.

- Business Continuity: Insurance ensures that an unexpected event, such as a lawsuit or cyberattack, doesn’t derail your operations.

As highlighted by Next Insurance, peace of mind is one of the most underrated yet valuable benefits of having the right coverage.

Web Designer Insurance FAQs

Do web designers need insurances?

Yes, freelance web designers absolutely need insurance to protect themselves from unexpected risks and liabilities. While freelancing offers flexibility and independence, it also comes with unique challenges such as client disputes, missed deadlines, or cybersecurity threats. Without insurance, even a small mistake can lead to costly lawsuits or financial losses.

For example, a client might claim that your design caused their website to malfunction, leading to lost revenue. Having professional liability insurance for freelance web designers ensures you’re covered in such situations. It also boosts your credibility with clients, as many require proof of insurance before starting a project.

2. What Happens If I Don’t Have Insurance for My Web Design Business?

Operating without insurance exposes your web design business to significant financial and legal risks. Here’s what can happen if you don’t have web designer insurance:

- Client Lawsuits: A dissatisfied client could sue you for perceived errors, missed deadlines, or financial losses caused by your work. Legal fees and damages can quickly add up, potentially bankrupting your business.

- Cybersecurity Breaches: If you manage client data or e-commerce platforms, a cyberattack could leave you liable for damages and recovery costs. Without cyber liability insurance for web designers, you’d have to cover these expenses on your own.

- Equipment Loss: Your computer or software is essential for your work. If it’s damaged or stolen, replacing it without insurance can be a significant financial burden.

By investing in the right insurance, you safeguard your livelihood and ensure your business can weather unexpected challenges. Learn more about protecting your business at Awifu Labs.

3. Can I Get Insured for Working Remotely as a Web Designer?

Yes, you can absolutely get insurance while working remotely as a web designer. Many insurance providers offer policies specifically tailored for remote freelance web designers or small business owners. These policies are designed to cover the unique risks associated with remote work, such as:

- Professional Liability: Protects against claims of negligence or missed deadlines, even if you work from home.

- Cyber Liability: Covers data breaches and cyberattacks, which are increasingly common for remote workers.

- Equipment Protection: A business owner’s policy (BOP) can cover your home office equipment, such as computers and servers, in case of theft or damage.

Providers like Next Insurance and Hiscox specialize in remote worker policies, making it easy to get affordable and comprehensive coverage.

Tips to Save Money on Web Designer Insurance

1. Bundling Policies for Discounts

One of the easiest ways to save money on web designer insurance is by bundling multiple policies with the same provider. Many insurers offer discounts when you combine essential coverages like professional liability insurance, general liability insurance, and cyber liability insurance into a single package, often referred to as a business owner’s policy (BOP).

- Benefits of Bundling:

- Lower overall premiums compared to purchasing separate policies.

- Simplified management with one provider handling all your coverage.

- Added protections, such as property insurance, for a reduced rate.

For example, Hiscox and Next Insurance offer customizable BOPs tailored to small businesses, including web designers. Bundling ensures you’re fully protected while keeping costs down.

2. Increasing Your Deductible

Another way to reduce your premiums is by increasing your deductible—the amount you pay out of pocket before insurance kicks in. A higher deductible means lower monthly or annual premiums, making this a cost-effective option for those willing to take on slightly more financial responsibility upfront.

- How It Works:

- Example: If your professional liability policy has a deductible of $500, raising it to $1,000 could significantly lower your premium.

- This strategy is ideal if you rarely file claims or have emergency savings to cover minor incidents.

When adjusting your deductible, ensure it’s a manageable amount in case you need to make a claim. Providers like Thimble and Progressive Commercial allow you to customize deductibles for flexible pricing.

3. Maintaining a Clean Claim History

Insurance providers often reward businesses with a history of few or no claims by offering lower premiums or discounts over time. A clean claim history demonstrates that you’re a low-risk customer, which insurers value.

- Tips to Maintain a Clean Record:

- Use clear contracts to outline project expectations and prevent disputes.

- Implement strong cybersecurity measures to avoid data breaches and cyberattacks.

- Regularly communicate with clients to manage expectations and resolve issues early.

By reducing the likelihood of incidents, you can avoid filing unnecessary claims, ultimately keeping your premiums lower.

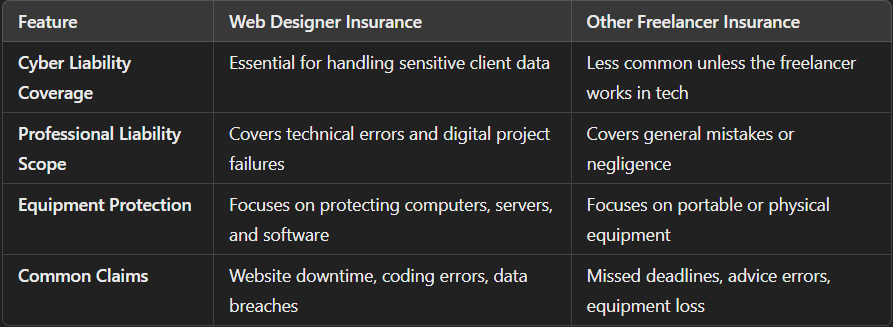

Web Designer Insurance vs. Other Freelancer Insurance: What’s the Difference?

Freelancers across industries face risks that require insurance, but the specific needs of web designers differ significantly from those of other freelancers. Understanding these differences is key to choosing the right coverage for your business. Let’s break it down:

1. Web Designer Insurance: Tailored to Digital Risks

Web designers face unique challenges due to the nature of their work, which involves creating and managing websites, handling sensitive client data, and meeting tight deadlines. Web designer insurance is specifically designed to address these risks.

Key Coverages for Web Designers:

- Professional Liability Insurance (Errors and Omissions):

- Covers claims related to mistakes, missed deadlines, or unmet expectations in your designs.

- Example: If a coding error causes a client’s e-commerce site to crash, this policy can cover legal fees and damages.

- Cyber Liability Insurance:

- Protects against data breaches, cyberattacks, and other digital threats.

- Example: If a hacker compromises your client’s sensitive data, this coverage helps with recovery and client compensation.

- Business Owner’s Policy (BOP):

- Combines general liability and property insurance to protect your office equipment like computers, servers, and software.

Why It’s Unique:

Unlike general freelancer insurance, web designer insurance includes protection for digital risks like cyber threats and technical errors that can disrupt client operations.

2. Other Freelancer Insurance: Generalized Coverage

Freelancers in other industries—like writers, graphic designers, or consultants—may not face the same level of technical or cyber risks as web designers. However, they still need protection against common liabilities.

Key Coverages for Other Freelancers:

- General Liability Insurance:

- Covers accidents like property damage or injuries caused during business activities.

- Example: A graphic designer accidentally spills coffee on a client’s equipment during a meeting.

- Professional Liability Insurance:

- Protects against claims of negligence or errors in work, though these claims may not involve complex technical issues.

- Example: A consultant provides incorrect advice that results in financial loss for their client.

- Inland Marine Insurance:

- Covers portable equipment like cameras or laptops that are used offsite, which is common for photographers or videographers.

Why It’s Different:

For freelancers outside the web design niche, insurance focuses more on general risks like physical equipment loss or client disputes, rather than cyber or technical liabilities.

3. Key Differences Between Web Designer Insurance and Other Freelancer Insurance

4. Do You Need Both Types of Insurance?

If you’re a freelancer offering multiple services (e.g., web design and consulting), you may need a mix of specialized and general coverage. For instance:

- Web designers who also provide branding or consulting may benefit from a broader professional liability policy.

- Freelancers handling sensitive client data should prioritize cyber liability coverage.

Providers like Hiscox and Next Insurance offer customizable plans that cater to multiple industries.

5. Choosing the Right Insurance

To determine which type of insurance you need:

- Assess Your Risks:

- Web designers face digital risks, while other freelancers may deal with physical or generalized client liabilities.

- Consider Your Tools and Clients:

- Web designers need coverage for software and digital systems, while photographers or writers may prioritize portable equipment coverage.

- Look for Flexible Policies:

- Providers like NEXT can help you explore options tailored to your unique needs.

- Providers like NEXT can help you explore options tailored to your unique needs.

How Web Designers Can Protect Themselves Beyond Insurance

While having insurance is essential for safeguarding your web design business, there are additional proactive measures you can take to reduce risks and protect yourself. These strategies help you minimize the likelihood of disputes, data breaches, and other challenges, ensuring smooth operations and happy clients.

1. Use Clear Contracts for Every Project

Contracts are the foundation of a successful client relationship. A well-drafted contract sets expectations and protects you in case of disagreements.

- Key Elements to Include:

- Project scope: Clearly define deliverables, deadlines, and revisions.

- Payment terms: Specify rates, payment schedules, and late payment penalties.

- Ownership rights: Clarify who owns the design after completion.

- Dispute resolution: Outline how disputes will be handled (e.g., mediation or arbitration).

Using tools like HelloSign or DocuSign allows you to create and manage contracts easily.

2. Maintain Strong Cybersecurity Practices

Web designers often handle sensitive client data, making cybersecurity a top priority. A data breach or cyberattack can damage your reputation and lead to costly claims, even if you have insurance.

- Best Practices:

- Use strong passwords and two-factor authentication for accounts.

- Regularly update software, plugins, and frameworks to fix vulnerabilities.

- Install antivirus software and a firewall on all devices.

- Secure backups of all client projects and data in case of system failure.

For more insights on cybersecurity for small businesses, visit Awifu Labs.

3. Communicate Effectively with Clients

Miscommunication is a common cause of client disputes. Ensuring clear, consistent communication throughout the project can prevent misunderstandings and build trust.

- Tips:

4. Implement a Thorough QA Process

Quality assurance (QA) is crucial to delivering reliable websites and minimizing errors that could lead to client complaints.

- QA Checklist:

- Test website functionality across multiple devices and browsers.

- Verify links, forms, and interactive elements.

- Optimize loading speed and ensure mobile responsiveness.

- Validate all code to prevent technical glitches.

5. Backup All Work Regularly

Losing project files due to hardware failure or accidental deletion can harm your reputation and delay projects. Regular backups protect you from these risks.

- Backup Tips:

- Use cloud storage solutions like Google Drive or Dropbox.

- Maintain offline backups on an external hard drive.

- Automate backups with tools like UpdraftPlus for WordPress projects.

6. Establish Clear Payment Policies

Late or missed payments can disrupt your cash flow. Protect yourself by setting clear payment terms and requiring upfront deposits.

- Payment Tips:

- Request a 30-50% deposit before starting a project.

- Use invoicing software like QuickBooks or Wave.

- Charge late fees for overdue invoices, as outlined in your contract.

7. Stay Updated with Industry Trends and Tools

The web design industry evolves rapidly. Staying informed about the latest trends, technologies, and best practices helps you maintain a competitive edge and avoid potential issues.

- Ways to Stay Updated:

- Attend web design webinars and conferences.

- Follow industry blogs and forums like Smashing Magazine.

- Join professional communities like Behance or Dribbble.

8. Build a Strong Portfolio and Reputation

A professional portfolio and a solid reputation can reduce risks by attracting serious clients who value your expertise.

- Portfolio Tips:

- Showcase your best work and include client testimonials.

- Highlight projects that align with your target audience’s needs.

- Keep your portfolio updated to reflect your current skills and services.

Final Thoughts: Is Web Designer Insurance Worth It?

For web designers, insurance is not just an optional expense—it’s an essential investment in the stability and success of your business. In an industry where client expectations are high, and risks like lawsuits, data breaches, and project disputes are ever-present, having the right coverage ensures your business remains protected against unforeseen challenges.

Recap the Importance

- Financial Protection: A single lawsuit or cyberattack can result in devastating financial losses. Insurance safeguards your business by covering legal fees, damages, and recovery costs.

- Credibility and Professionalism: Clients trust insured professionals. Having insurance demonstrates that you are prepared for the unexpected and serious about your work.

- Peace of Mind: With the right coverage in place, you can focus on delivering exceptional designs without worrying about potential risks.

By investing in professional liability insurance, cyber liability insurance, and other relevant policies, you ensure that your business is prepared to handle the unique risks of the web design industry.

Encourage Readers to Take Action

Don’t wait for an issue to arise before taking steps to protect your business. Secure your future by investing in the right insurance today.

- Evaluate Your Needs: Assess the risks specific to your web design business.

- Compare Providers: Explore trusted insurers like Hiscox, Next Insurance, or Thimble.

- Get a Policy That Fits: Choose comprehensive coverage that aligns with your services and budget.

Bonus Suggestions

- Case Study: “How Insurance Saved a Freelance Web Designer from a Costly Lawsuit“

- Checklist: “5 Steps to Protect Your Web Design Business with the Right Insurance”

- Comparison Table: “Top Web Designer Insurance Providers Compared”